The Accountants and Tax Agents Institute of NZ (ATAINZ) is an incorporated society that aims to be the voice of small to medium businesses (SMEs) in New Zealand.

All ATAINZ members promise to professionally, ethically, and willingly look after the taxation needs of their clients, and are regarded as trusted advisers in the business community.

GBPensions director and Financial Adviser, Tony Chamberlain, is always at pains to explain that he is not a tax specialist, nor is he an accountant. However, he has been awarded his ATAINZ designation due to his expertise in pension transfers and relevant qualifications. “When discussing options with clients, tax mitigation is almost always a key influencer in deciding the most appropriate course of action,” he explains.

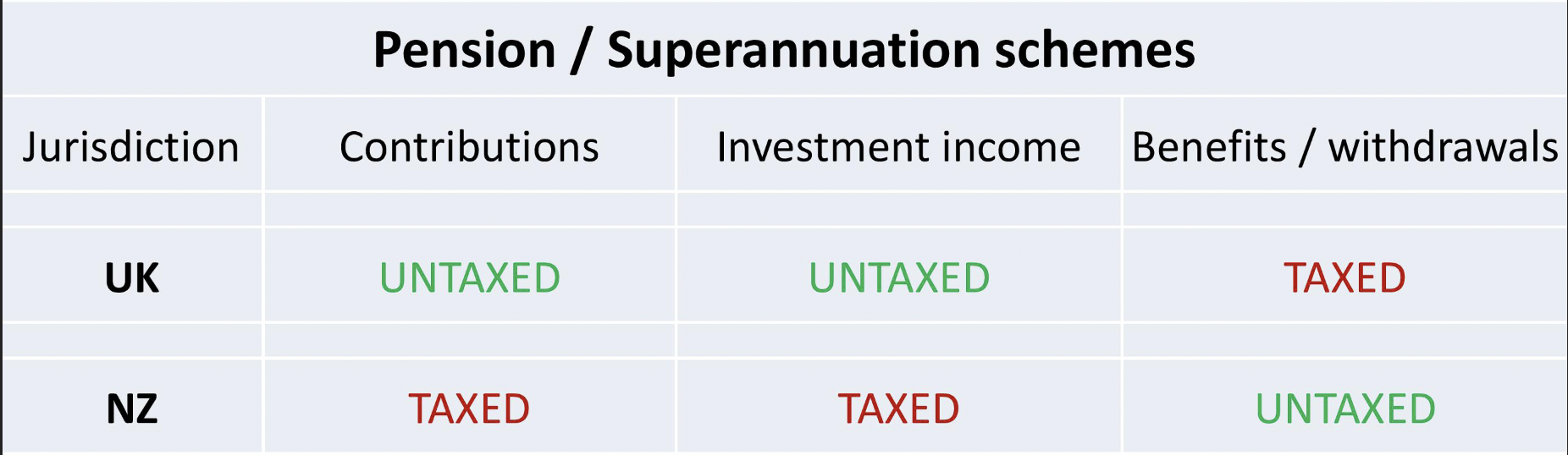

“There are tax implications with any of the three options – leaving the pension where it is in the UK, transferring it to an NZ QROPS, or moving it to a UK SIPP. It’s one of many factors that clients need to consider carefully.”

“Because this is a very complex area, we always urge clients to seek specialist tax advice from one of our trusted partners, both of whom have many years of relevant experience with the UK and NZ tax regimes.

“Our approval as an ATAINZ member recognises that we act with integrity and impartiality to safeguard our clients’ best interests.”

ATAINZ are required to comply with the organisation’s code of ethics, which covers four main areas:

- Integrity

- Trust and confidence

- Standards of service

- Professional conduct

The ATAINZ website states: “If you are working with an ATAINZ Member, you can rest assured that they are maintaining high ethical standards and have access to up-to-date resources. As trusted tax and business advisors, we are here to support our members and our clients.”