Financial scams seem to be everywhere. In this blog, we share a few tips from reputable sources, including the Financial Markets Authority and the Banking Ombudsman Scheme, about how to spot potential fraudsters.

NetSafe’s The State of Scams in New Zealand – 2023 suggests that 17 per cent of Kiwis have lost money to scammers, amounting to a shocking NZD2.05 billion stolen nationally.

A quick straw poll around GBPensions’ office building finds that pretty much all of us have been targeted by fraudsters in one way or another. Unfortunately, one of us was fooled by the criminals and endured the misery and traumatic repercussions that follow a bank fraud.

How do scams start?

Whether an apparent investment opportunity, potential romantic partner, alleged unauthorised bank activity, or fake purchase order, fraudsters are the ones who initiate contact with their targets via social media, letters, emails or phone calls.

The Financial Markets Authority (FMA) urges consumers to “ignore uninvited investment offers”, saying that:

- In New Zealand, it is illegal to sell financial products (such as shares) through an unsolicited meeting, for example a “cold call” or uninvited email.

- If you do receive a call, letter or email from a stranger about an investment opportunity, hang up, throw it away or block them.

- If they keep trying, contact the FMA, or ask your phone or email service provider to block them.

- If they become abusive or threatening, call the police on 105 for non-emergencies, or 111 if you are in immediate danger.

It also strongly advises against investing through offshore, online businesses, with this stern warning:

- It is often impossible to recover your money if an overseas investment turns out to be a scam. We cannot help you if things go wrong.

Cold calling through LinkedIn

GBPensions regularly receives enquiries from people who’ve been contacted out of the blue by “pension transfer specialists” who have found their details on LinkedIn.

We can’t comment on how many of these approaches are legitimate. However, based on what individuals have told us, we do know that, even if they are real businesses, they are not necessarily licensed and regulated in New Zealand. We asked LinkedIn about its cold calling policy, and this was the response:

LinkedIn does not share any member information with other members, in accordance with our privacy policy and professional community policy. Members are responsible for their own actions on the platform, and we strongly encourage all users to adhere to ethical practices and respect others’ privacy.

If you encounter any activity that seems inappropriate or unethical, please report it to us immediately so that we can take the necessary actions.

Invoice scams and recovery room scams

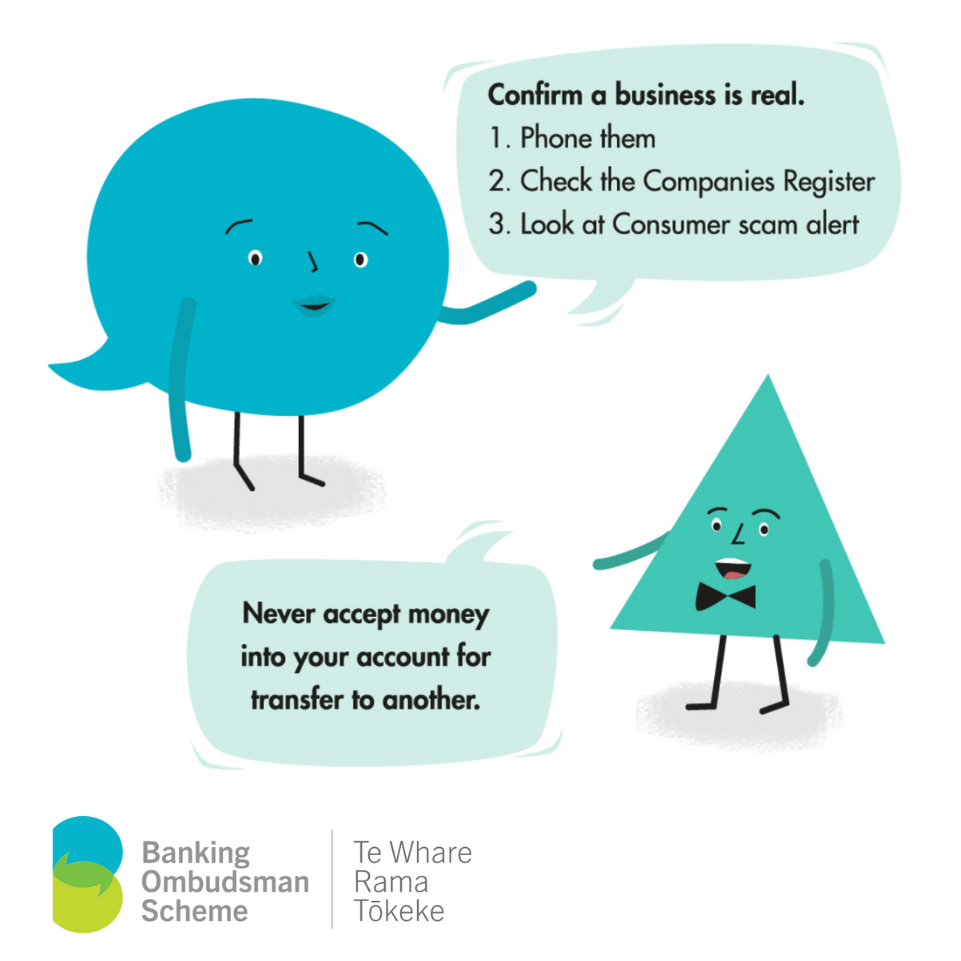

The Banking Ombudsman Scheme also highlights two possibly lesser-known activities.

An invoice scam is when a criminal hacks the email account of a legitimate company and alters invoices to request clients pay funds to a different account. Since the email and invoice look legitimate, these scams are hard to spot but simple checks can reveal them.

If you receive a request to pay a new or different account, we recommend you confirm the payment details using another form of communication (such as by phone). You may not be communicating with the person you imagine via email and a quick phone call can foil such deception.

Recovery room scammers seem especially cruel because they target people who have already lost money either through their own scam or another. They contact you and pretend they can help you – for a fee – get back the money you lost in online investment and trading scams.

Of course, these people won’t tell you how they’ll get your money back – but they will ask for an upfront fee. This is often via credit card, and once they have these details, they can run up significant amounts to that card.

The Banking Ombudsman Scheme advises extreme caution. If you’ve been a victim of a scam, be very careful about paying someone to help you get your money back. The person may not be genuine, and you may well be at risk of further losses. Instead, talk to your bank, the police or us – for free.

Some of the warning signs: how to spot a scammer

As we’ve said, scammers are always the ones who initiate contact. There’s likely to be a sense of urgency, e.g., a limited time opportunity, very few spaces available, essential software updates. And the product or service that they’re allegedly offering may only be available for an upfront fee.

Some fraudsters will use an “imposter website” designed to mirror a legitimate business, copying a logo and address. Look for subtle differences, such as .biz, .net, .center, or .work, or atypical overseas territories, like .ph or .ru, instead of the more usual .co.nz.

One golden rule is to contact the company you believe you’re dealing with via a publicly listed phone number, such as those given on the New Zealand Companies Office Register.

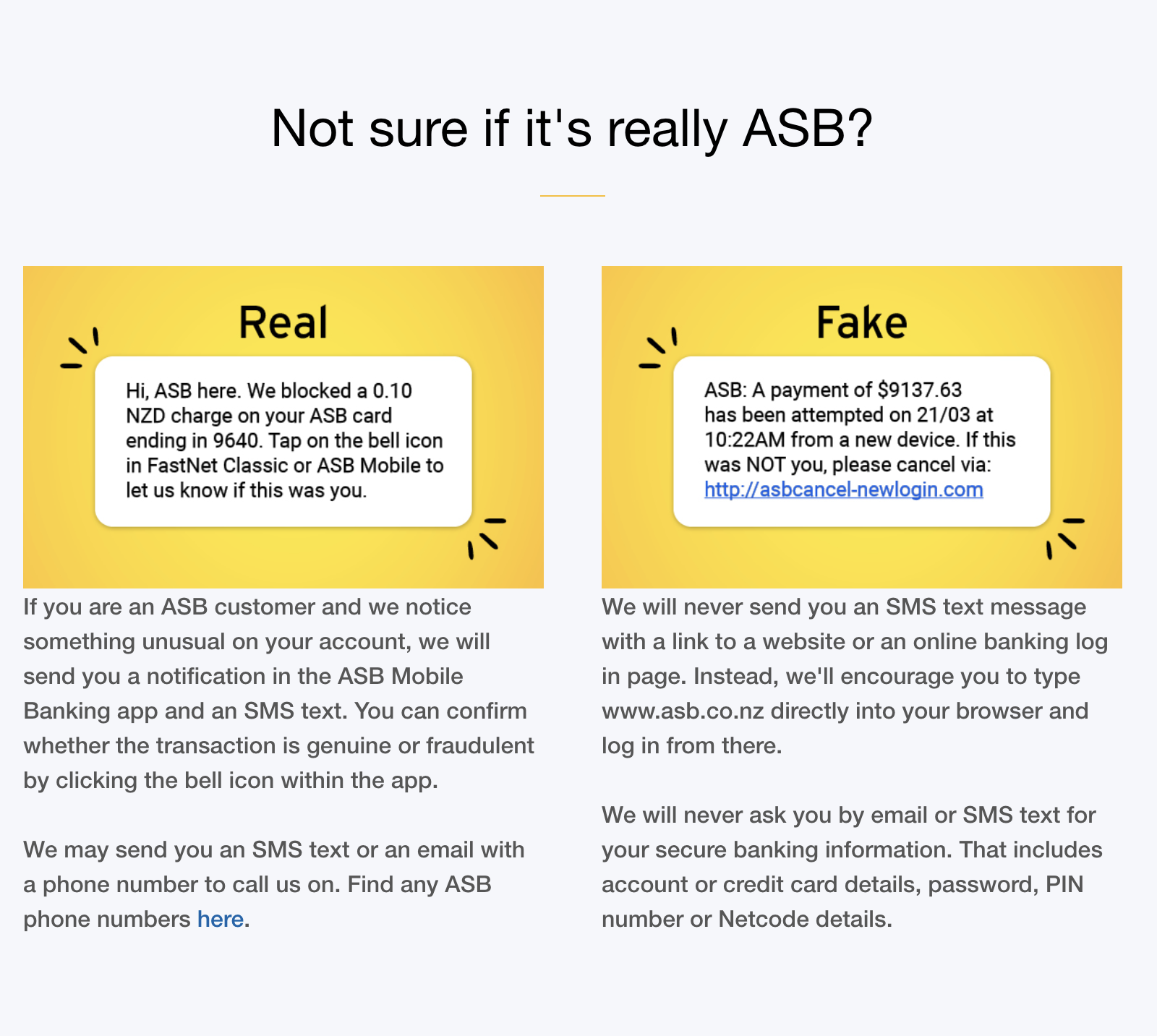

If someone calls you claiming to be from your bank – perhaps about “suspicious activity” on your card or asking you to confirm personal details – end the call and ring the bank back on one of the numbers in your banking app or the bank’s website. Failing that, and if it’s feasible, you could call into your local branch. If it’s a genuine query, any staff member will be able to check your details and direct you to the correct department.

It’s also worth keeping an eye on your bank’s website for up-to-date information about known scams.

The trouble with scammers is that they’re smart. They’re devious, manipulative, and can sound incredibly plausible. By taking a moment to stop and think before acting, hopefully, we can better protect ourselves.

Suggested further reading:

https://www.consumerprotection.govt.nz/general-help/scamwatch/avoiding-scams

https://www.police.govt.nz/advice/email-and-internet-safety/internet-scams-spam-and-fraud