There have been several major – some might say draconian – changes to legislation affecting the transfer of UK pension schemes in the last year or so. First we had the cut-off date for transferring unfunded statutory (public sector) pension schemes, then we had a significant cull of the NZ ROPS list (which notably affected KiwiSaver, of course.) The next overhaul coming later this year will seriously impact how much of a NZ superannuation pension fund can be accessed and when.

Presently, UK regulations allow a New Zealand superannuation scheme with QROPS status to pay members a lump sum amount of approximately 30% of their transferred UK fund at age 55, plus provide an income for life.

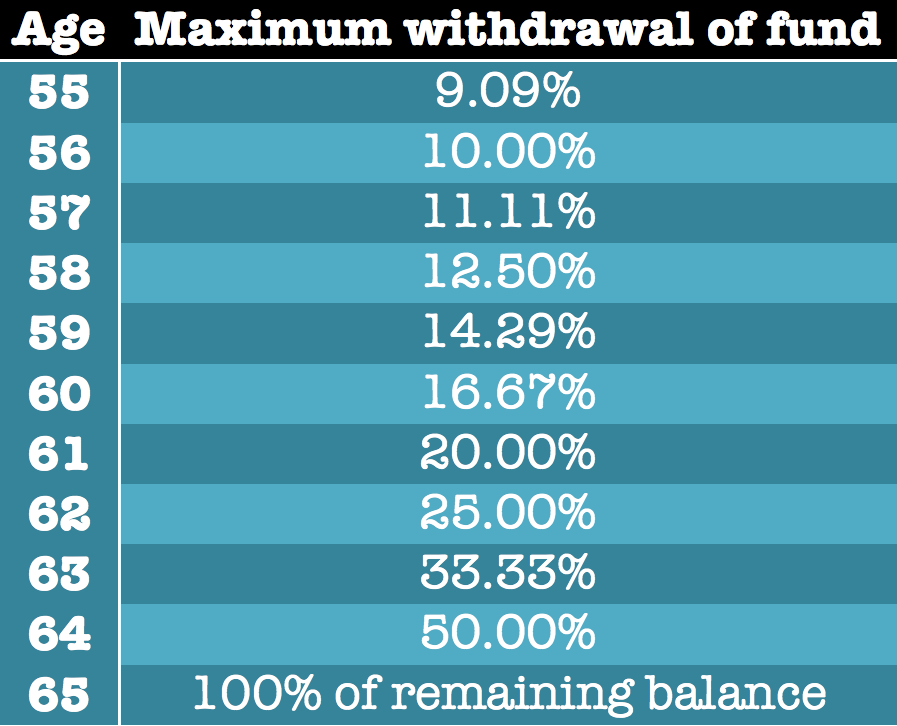

However, New Zealand legislation coming into force on 1st December 2016 will restrict withdrawals significantly, only allowing less than 10% in total to be paid at this age. Conversely, in later years where the new rules allow a higher withdrawal, these will be subject to the QROPS limits.

So by reference to the table here which highlights the new tiers, even though the NZ rules might permit 100% of the balance of the scheme to be paid out at age 65, the QROPS rules will not.

You can read more about these changes in this article from Interest.co.nz and in the Financial Markets Conduct Regulations, Schedule 12 “Superannuation Scheme Rules.”

A pension transfer to a SIPP or NZ QROPS may not be relevant or appropriate in all instances. The decision whether or not to transfer is complex, and it is important to consider the benefits, risks and disadvantages before determining if a transfer is suitable. GBPensions recommends that all clients seek independent financial and tax advice, personalised to their individual circumstances.

Having considered the advice, if you deem a transfer is appropriate for you, you should think carefully about acting prior to 1st December 2016. Please note: you can still transfer your pension/s after this date, but you will be subject to the new legislation as noted above.

Please note: the information given in the table above is based on GBPensions’ understanding of current and proposed legislation, and is therefore subject to verification and change.

Original blog posted 7th April 2016. Updated for content 4th July 2016.